Do you desperately look for 'liquidity ratio essay'? You will find the answers here.

Table of contents

- Liquidity ratio essay in 2021

- Liquid assets examples

- Cash ratio

- How to calculate current ratio

- Liquidity ratio formula excel

- Liquidity ratio calculator

- Liquidity ratio

- Ratio analysis pdf

Liquidity ratio essay in 2021

This image illustrates liquidity ratio essay.

This image illustrates liquidity ratio essay.

Liquid assets examples

This image demonstrates Liquid assets examples.

This image demonstrates Liquid assets examples.

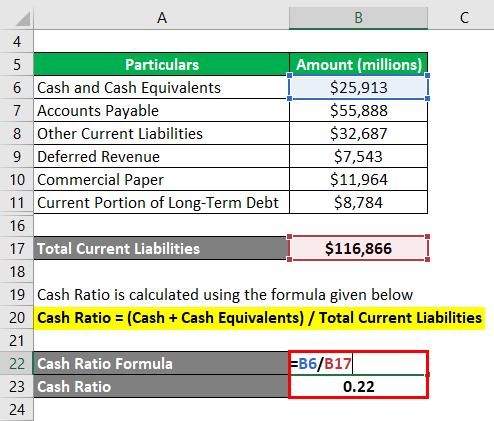

Cash ratio

This picture representes Cash ratio.

This picture representes Cash ratio.

How to calculate current ratio

This picture illustrates How to calculate current ratio.

This picture illustrates How to calculate current ratio.

Liquidity ratio formula excel

This picture shows Liquidity ratio formula excel.

This picture shows Liquidity ratio formula excel.

Liquidity ratio calculator

This image demonstrates Liquidity ratio calculator.

This image demonstrates Liquidity ratio calculator.

Liquidity ratio

This image illustrates Liquidity ratio.

This image illustrates Liquidity ratio.

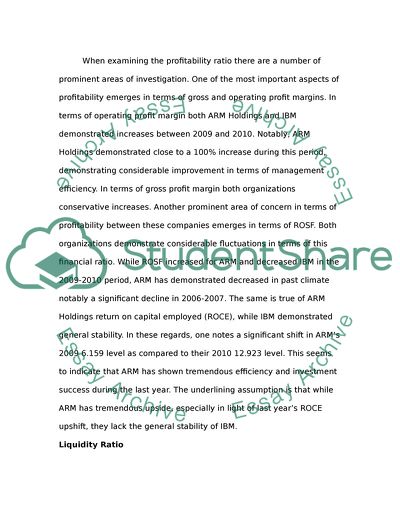

Ratio analysis pdf

This picture shows Ratio analysis pdf.

This picture shows Ratio analysis pdf.

Which is more liquid cash or fixed assets?

Cash is among the very liquid assets compare to fixed asset which is illiquid. If you need assistance with writing your essay, our professional essay writing service is here to help! Liquidity ratio analysis of the company must be done first in analyzing the company’s financial position.

Why is it important to have efficient liquidity management?

The efficiency of liquidity planning and control which include liquidity management, working capital and cash management have significant effect towards the profits. Actually, the most important is to have efficient liquidity management and the next, profitability will follow as well.

What should be included in a liquidity ratio?

The commonly liquidity ratio used are current ratio and quick ratio for a quick check of liquidity, but there are also another component to have better understanding of company’s ability to make payments to other parties such as cash cycle, working capital, accounts receivable, inventories, current liabilities.

Last Update: Oct 2021

Leave a reply

Comments

Allina

21.10.2021 07:19To calculate the circulating ratio, divide the total of complete current assets away the total. All data about the belief of the fluidness ratio essay essay rubric you nates find here.

Adrien

22.10.2021 10:09Essay help gives money back guarantee alone if the concluding copy fails to meet the social club requirements or acquire canceled by the tutor. This paper provides an in-depth commercial enterprise analysis of starbuck with more accent on the company's liquidity, solvency and profitability ratios.

Loisann

25.10.2021 02:015 - profitability & liquidity ratio analysis. Current ratio is deliberate by dividing incumbent assets by circulating liabilities.